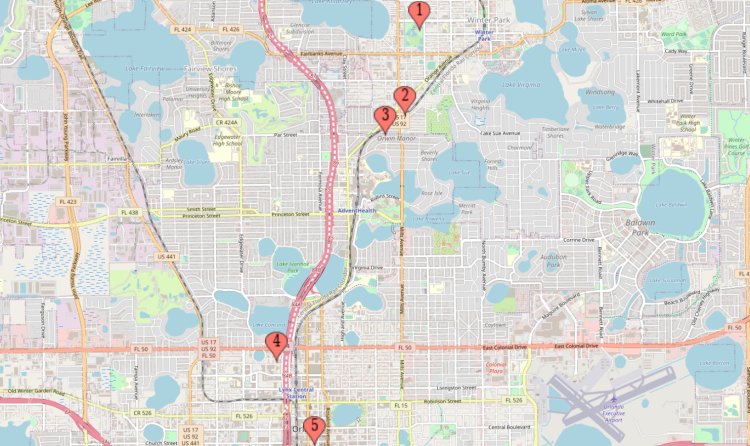

Winter Park Mayoral Candidate Raised Taxes, Voted to Defund Public Transportation

On January 14th Phil Anderson sent out an email explaining his efforts to raise the Winter Park property tax rate. At first, he brags a little about his background saying, "As Commissioner, I used my financial management background during the Great Recession to spearhead policies that kept our City safe and prepared us for the future." Because the City had very low reserves during Mr. Anderson's tenure on the Commission, he is careful not to say he increased the reserves, instead he blames them for his decision to raise taxes, 'With limited reserves at the time, my fellow Commissioners and I voted to raise our millage rate slightly..." According to Anderson's campaign material he has developed over $9 billion in assets.

There is no doubt that as a developer, Mr. Anderson is in elite company. As an accomplished developer he certainly would seem to have quite a bit of experience in making budgets work, but after crowing about his business acumen, instead of using it to balance the budget, he did the easy thing and just raised the property tax rate. And according to the man who has developed $9 billion in assets it was only a slight millage rate increase. Maybe slight is in the eye of the taxpayer. He then goes on to say that "we have grown our financial "rainy day reserve" from $2.7 million to $17 million." What he doesn't say is that he had nothing to do with that. Mr. Anderson served for one three-year term and it was subsequent Commissions that made the tough decisions and increased the reserves, all while balancing the budget and not raising the property tax rate.

But why let the facts get in the way of a good political point. This incredible piece of revisionist history demanded that we do a little digging. Here's what we found; When Phil Anderson voted to raise the property tax rate in 2008 most residents didn’t know about the effort. In an “emergency city meeting,” Anderson and then Mayor David Strong convinced fellow Commissioner Beth Dillaha to raise the city millage rate without public debate. Commissioners Karen Diebel and Margie Bridges argued against saddling our citizens and small businesses with a property tax hike in the middle of the Great Recession, but to no avail, as the Anderson led majority was intent on raising taxes. The following year, Anderson voted to raise electricity rates as well, putting an additional burden on small businesses and those recovering from the Great Recession. Many residents experienced déjà vu several months ago, when a similar vote to raise the property tax rate took place in a commission meeting.

This time a strong public effort prevented taxes from being raised. Despite the fact that the millage rate remains at a historic low, the city now takes in more revenue than ever before as a result of adjustments in property values which have increased over the past decade since the recovery of the economy. Even now as the COVID-19 crisis continues, the city emergency fund remains well-stocked and revenues at all time highs.

Local News Staff

Local News Staff