Local Journalist Tax Credit Bolsters Discourse

With subsidies from parent companies and revenue from the posting of public notices, most corporate publications outcompete small boutique papers and local news publications. That's why, despite some flaws in its flue, we believe the recent tax carve out for local journalists will bolster discourse in America.

"Of course," you might say, "the Local News supports a 'hand out' for their industry." But on balance, the local journalist tax credit's scope is of marginal size when compared to solar credits, farm credits, and the child tax credit, which is refundable (in other words the government gives parents cash).

Unlike the child tax credit, the local journalist credit would come in the form of a payroll tax credit for companies that employ eligible local journalists. The measure would allow newspapers, digital news outlets, radio and television stations to claim a tax credit of $25,000 the first year and $15,000 the next four years for up to 1,500 journalists.

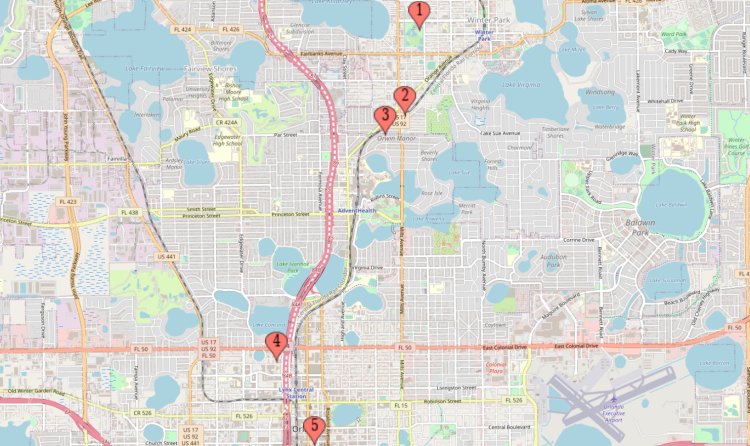

One-fourth of the country's newspapers have closed and half of local journalism jobs have evaporated in the past 15 years, according to research from the University of North Carolina.

That leaves about 1,800 communities without a local newspaper.

"This is only a reluctant response to this fear of the collapse of local news and their business models," said Steven Waldman, president and co-founder of Report for America, an organization that places journalists in local newsrooms, including The Associated Press. "Most journalists start off with a healthy skepticism about the government getting involved and helping journalism. And that's appropriate."

"But," he added, "the reason why this is happening now is just the severity of the crisis."

Government support for media, in ways direct and indirect, is not new. It goes back to the earliest days of the country when Congress subsidized periodicals' postal rates. More recently, a pandemic-era small business loan program provided millions to news organizations.

The credit also has bipartisan support with sponsors Rep. Ann Kirkpatrick, D-Arizona and Rep. Dan Newhouse, R-Washington introducing the legislation last year.

The proposal has been encumbered by criticism from some tax hawks, however. Grover Norquist's recent article entitled "Democrats' $3.5T reconciliation bill's top 10 woke handouts" aims to attack the legislation.

Norquist did not mention farm subsidies, solar credits, adotion credits, the home office deduction, Olympic medal deductions, the mortgage interest deduction, the gambling loss deduction, the child tax credit, the credit for electric plug-in vehicles or the buy-borrow-die loophole.

Most local journalists welcome the legislation's new provisions in an era of hyper-partisanship and fake news. We applaud this bipartisan addition to the bill and look forward to brighter days for the industry in the future.

Orlando Local News Editorial Board

Orlando Local News Editorial Board